The How is the market?

This by far is

the most common question I am asked regarding real estate. This week, with the

anniversary of the South Napa Quake, the question was how is the market

compared to a year ago? Have we recovered for that?

In all honesty,

the earthquake had only a minimal impact on the market. Real Estate has been

chugging along since 2012 and that event provided only a minor speedbump in the

trend.

I love a few good

charts so here we go.

First question is

always about price. We have been seeing prices increase in both terms of median

price and price per square foot for years when looked at as a Year over Year

comparisons.

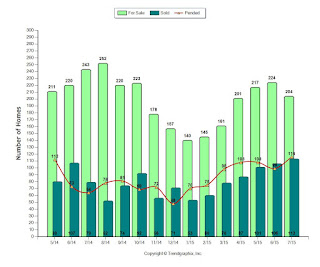

Second question

comes to inventory.

We had a glimmer

of hope earlier this year that inventory might be improving, but that was

quickly swallowed up by the demand from buyers. We are still struggling to get

a good supply of inventory (if you are thinking of selling … call me for my

100% list price GUARANTEE)

-Kris

Home Tip of the week.

Have you been

watching the stock market this week?

To say it has

been a little volatile would be an understatement. But when it comes to

investing, unless you are a day trader, we tend to forget that the market has been

doing incredibly well for the last 7+ years.

The Dow Jones

Industrial Average is up from the 10000 threshold hit in 2010. The DJIA

surpassed the previous high of approximately 14,000 (pre-recession) in January

of 2013.

But these events

of the past two weeks have reminded me of the great advice I get from Mark

Richmond at LPL Financial.

Here is Mark’s

tip for getting your financial house in order. You can contact Mark at

707.603.2663 or m.richmond@lpl.com for a review of your financial home

as well.

Getting your

house in order applies to more than your home; it applies to your physical,

mental and fiscal well-being. For most

of us today our lives run at an incredible pace: kids, school, work, social

obligations and the upkeep and maintenance of our home and finances. Most of the experts agree that if you want to

accomplish tasks without fail, make them habits. A habit is something you accomplish after

repeating an activity 12-times in succession.

An easy way to make sure that you accomplish home and financial

maintenance is to build routines or habits.

MAKE IT A HABIT

Create a 12-month

calendar of your financial and home maintenance chores. For your home it will include things like

gutter maintenance, carpet care, setting your clocks for each time change and

changing furnace and water filters and seasonal cleaning. For your finances it is reviewing your

savings and retirement plans annually, budgeting your monthly expenses and tax

liabilities. January tends to be a good

month to budget for the year. Budget

both the necessities and more discretionary items like vacations and

automobiles. For your home, make sure

your gutters are not full and that your weather stripping is holding – they

both have a few more months of abuse to endure.

April tends to be a good time to look at your tax and savings

habits. You’ve just digested your annual

visit with the IRS (aka filed your tax return) and so can evaluate where your

retirement plan is taking you and increase (or not) your 401(k) or IRA

contributions to provide you with tax and retirement relief. March and April are also the traditional

“Spring Cleaning” months and the month you set your clock forward (March 9th,

2014). Change your heater, water and air

conditioner filters.

May and June are

gardening and outdoor improvement months in preparation for the summer and are

also a great months to think about your educational savings plan for your

children and grandchildren. October tends

to be a good month to prepare for winter by changing your heater and water

filters and making sure you will maximize your tax deductions for the year and

have adequately prepared for any tax liabilities. Review and reforecast your budget too as the holidays

are just around the corner. Cut out

unnecessary expenses (the 10,000+ Cable TV channels you now pay for but rarely

watch) and any other unwanted services or unread subscriptions that may have

accumulated over the year.

By making these

tasks a habit you will better maintain your home and personal finances. For more information and helpful hints,

please subscribe to our firm’s online newsletter by emailing

mark.richmond@napavalleyfinancial.com and placing “Newsletter” in the subject

line.

No comments:

Post a Comment